Until then a transitional arrangement will be in place to help. THEEDGE MALAYSIA I OCTOBER 13 2014 GST implementation forum 81 what.

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Based on the Malaysian GST model the price effects are minimal due to.

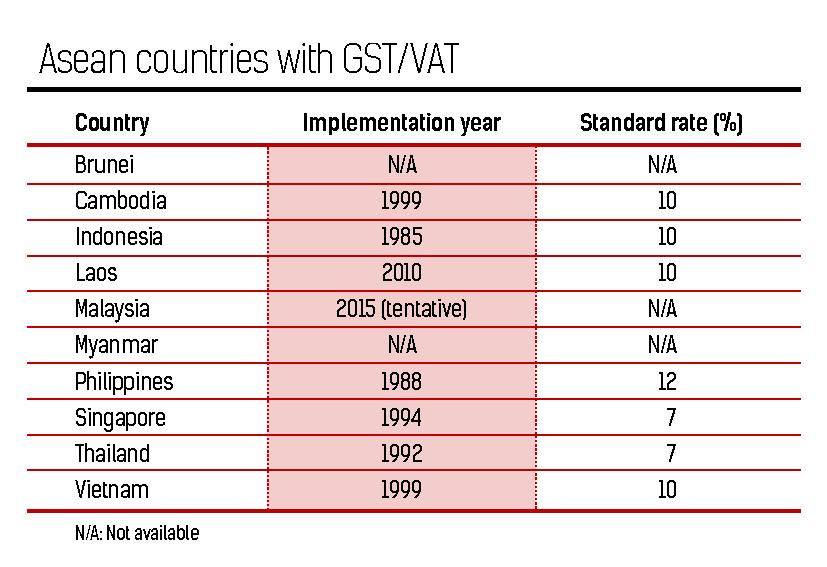

. Malaysia may look at a possible implementation of the Goods and Services Tax GST in the medium term likely by 2022 or 2023 to help correct the. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018. Overview of Goods and Services Tax GST in Malaysia.

If GST is implemented the Government will provide ample time between 18 to 24 months for the businesses and industries to prepare. To modernise its taxation system and improve business efficiency Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. It marked the beginning of a path-breaking tax reform in our country.

At this point in time the rate may be slightly higher. To date there are less than 10 thousand companies that has filed for registration with the Malaysian Royal Customs. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST.

Evolution of GST in India. The Government has not determined the implementation date of GST in Malaysia. THEEDGE MALAYSIA I OCTOBER 13 2014 GST implementation forum 81 what do you need to do.

Off the targeted mark of 300 thousand. Hence the GST implementation date was set as 1st July 2017. Segala maklumat sedia ada adalah untuk rujukan.

He Goods and Services Tax GST implementation date of April 1 2015 is less than seven. Although no firm date has been set Dr Mahathir has stated that SST will be implemented in September 2018. GST is a significant indirect tax.

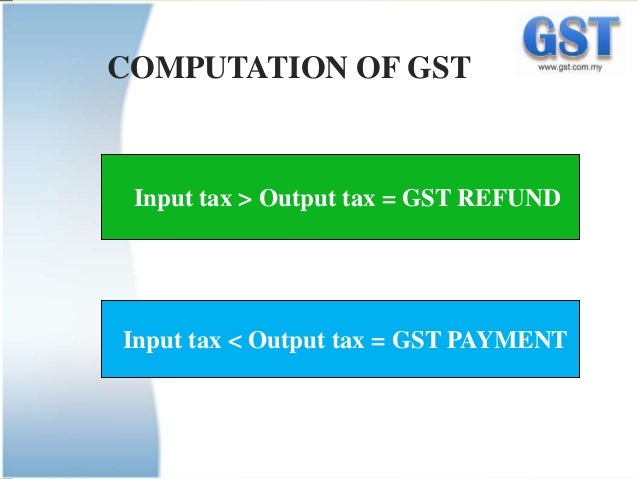

For GST Malaysia there are 3 types of. GST Implementation in Malaysia The Argument. 603-7785 2624 603-7785 2625.

There were being quite a few responses when the Malaysian government to start with declared the Financial Funds for Malaysia yr 2010. Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

A major concern about the implementation of the GST is the resulting price effects on consumers. A major concern about the implementation of the GST is the resulting price effects on consumers. Before the 6 GST that was.

The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6. Based on the Malaysian GST model the price effects are minimal due to. Presently the Government is actively involved in providing awareness and knowledge on the.

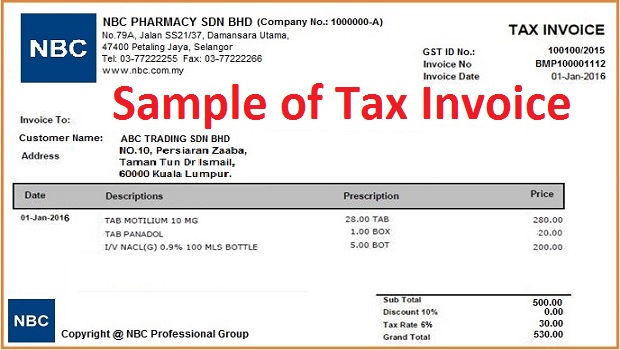

GST Implementation in Malaysia The Argument. Goods Services Tax GST is now Law in Malaysia and to be formally known as Goods And Services Tax Act 2014.

Gst Malaysia Implementation Date Arturodsx

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst Malaysia Implementation Date Savannagwf

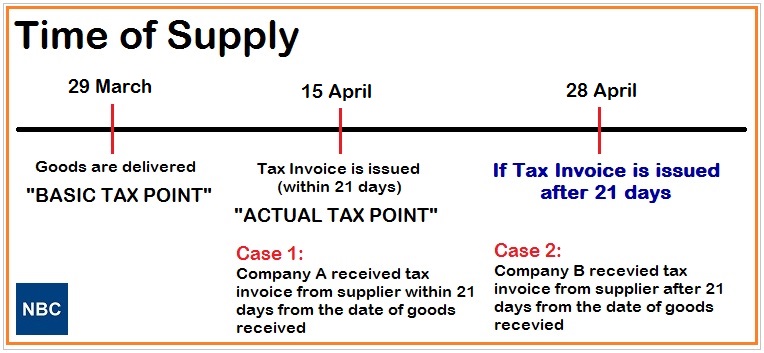

What Is 21 Days Rule In Gst Time Bomb In Gst Goods Services Tax Gst Malaysia Nbc Group

Gst Training Accounting For Gst Malaysia Jason Tan Associates

How To Start Gst Get Your Company Ready With Gst

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Malaysia Implementation Date Savannagwf

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

An Introduction To Malaysian Gst Asean Business News

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Free Resources Archives Goods Services Tax Gst Malaysia Nbc Group

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog